“PPP is a cooperative venture between the public and private sectors, built on the expertise of each partner that best meets clearly defined public needs through the appropriate allocation of risks resources and rewards.”

— The Canadian Council on Public-Private Partnerships

"A long-term contract between a private agent (or private economic operator) and a public agent (also referred as government authority or public authority), for the development and/or management of a public asset or service, in which the private agent bears significant risk and management responsibility thorough the life of the contract, and remuneration is significantly linked to performance, maintenance and/or the demand or use of the asset or service.”

— The World Bank Group

PPP Fundamentals is aimed at individuals working at building a basic level of PPP knowledge, with little or no prior experience. It aims to standardize knowledge of the PPP process and terminology as described in the PPP Guide. The course aims to give participants sufficient knowledge and understanding to act as an informed team member of a PPP project, enabling them to participate in a team environment and move on to implementing the PPP process.

After the completion of this course, participants may optionally write the Public-Private Partnership Foundations exam from APMG. This certification is a pre-requisite for writing the two Certified Public-Private Partnership Professional (CP3P) certification exams. The CP3P Foundation exam tests whether a participant has sufficient knowledge and understanding of the established procedures, rules and institutional responsibilities related to the selection, implementation and management of PPP projects, as outlined in the PPP Guide. This includes terms used, process sequences, and roles involved. The closed book, multiple-choice exam consists of 50 questions to be completed within 40 minutes. Participants must achieve a minimum score of 50% (25 marks) to pass the exam.

The APMG PPP certification program is an innovation of the Asian Development Bank (ADB), the European Bank for Reconstruction and Development (EBRD), the Inter-American Development Bank (IDB), the Islamic Development Bank (IsDB), the World Bank Group (WBG) and part funded by the Public-Private Infrastructure Advisory Facility (PPIAF) with a shared vision of enhancing PPP performance globally. CP3P is the definitive credential to demonstrate that one's abilities are aligned with international PPP good practice.

This course provides participants with the practical skills to:

This course is designed for those with little to know prior experience who are starting to work on a public-private partnership project, or who are interested in doing so in the future.

There are no prerequisites for this course.

Participants in this course will receive a course workbook with copies of all presentation materials, handouts and case studies. In addition, they will receive a copy of the PPP Guide and a practice exam to help them prepare for the APMG CP3P Foundations exam.

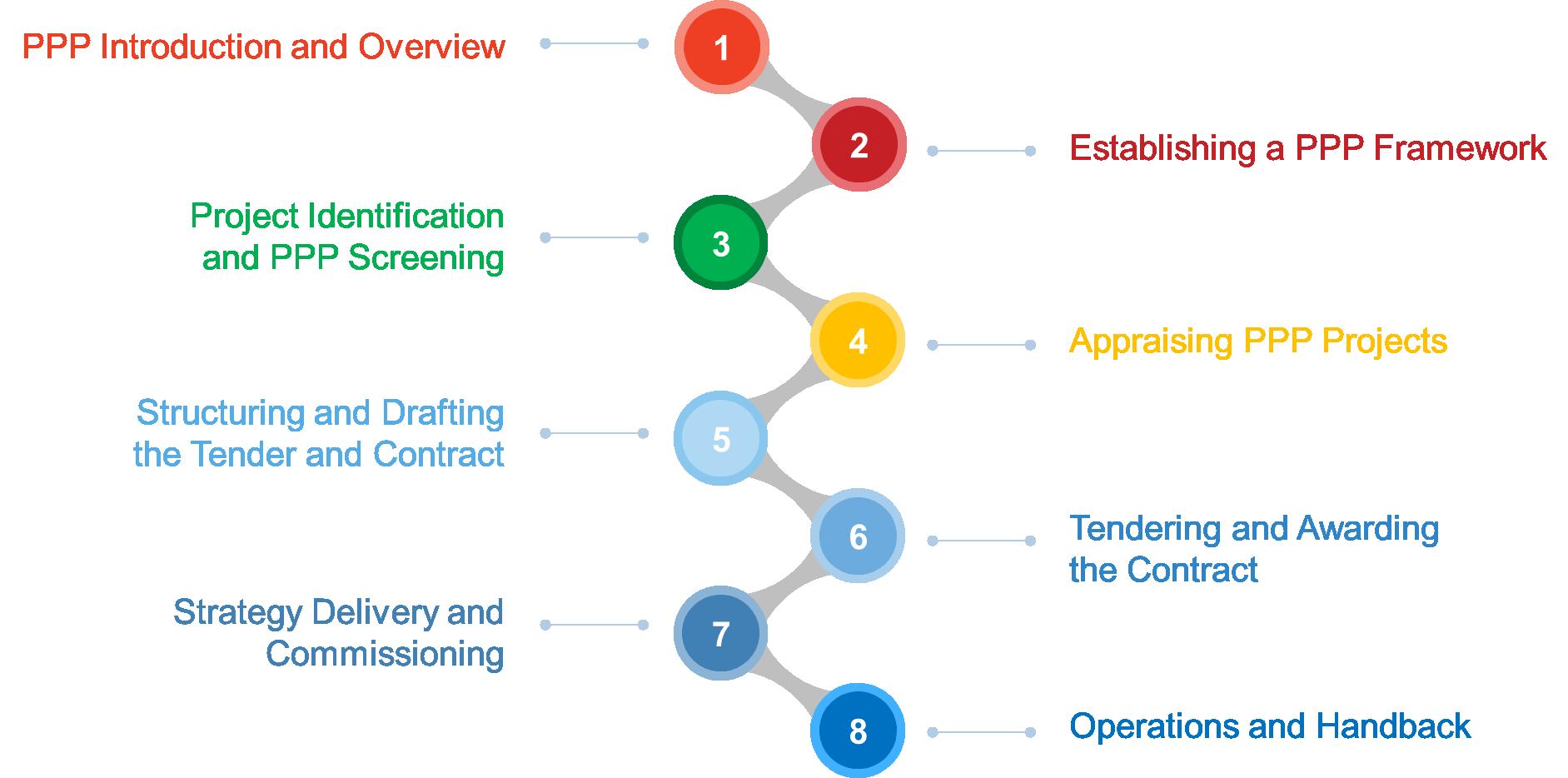

The PPP Certification Program Guide, referred to as the PPP Guide, is the Body of Knowledge (BoK) on public-private partnerships (PPPs). It helps public officials and their advisors implement efficient, sustainable PPPs based on the following format:

This three-day course focuses on the ten sections that comprise the first chapter of the PPP Guide.

Course ID: 4801

Course Level: Intermediate

Duration: 3 days

Sessions not found.

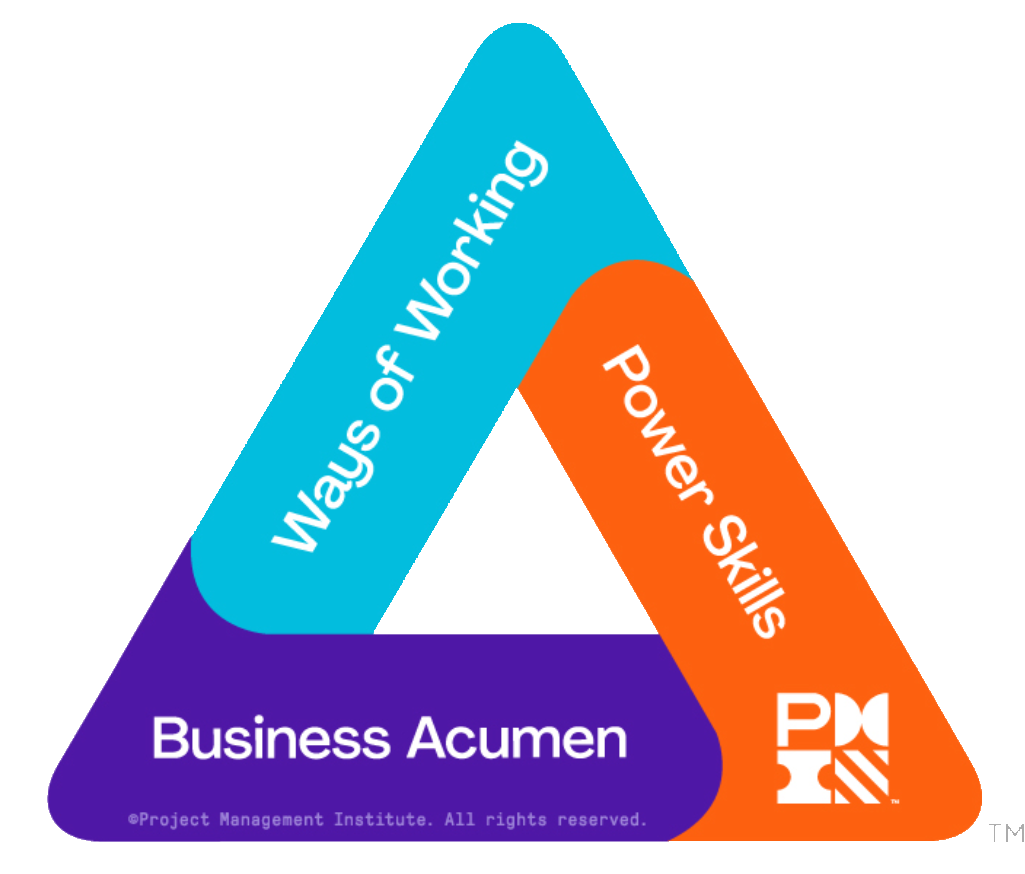

The following table provides the breakdown of the professional development units (PDUs) for this course aligned with the PMI Talent TriangleTM.

The following table provides the breakdown of the professional development units (PDUs) for this course aligned with the PMI Talent TriangleTM.

| WoW | PS | BA | |

| PMP | 0 | 0 | 21 |

| PgMP | 0 | 0 | 21 |

| PfMP | 0 | 0 | 21 |

| PMI-ACP | 0 | 0 | 21 |

| PMI-SP | 0 | 0 | 21 |

| PMI-RMP | 0 | 0 | 21 |

| PMI-PBA | 0 | 0 | 21 |

The three columns in the above table are Ways of Working, Power Skills & Business Acumen.

Other professional (re)certification credits are available, including: